us exit tax calculation

Non - U S. Get professional tax help.

Selling Your Home Here S How The N J Exit Tax Works Nj Com

With the deemed disposition of capital assets your exit tax is calculated as though you have sold your worldwide property for fair market value FMV the day before you.

. The exit tax is generally payable immediately ie April 15 following the close of the tax year in which expatriation occurs. For purposes of calculating the exit tax the built - in gain or loss of each asset is computed by subtracting the assets adjusted basis from the assets FMV id. The second way to become a covered expatriate is to have a high-enough average net income tax liability for the five tax years before the year of expatriation.

Calculating the exit tax is tricky in general but if youve got retirement accounts and foreign pensions it jumps to a whole new level of complexity. The US Exit Tax calculation is not straightforward especially when pensions are involved. The US imposes an Exit Tax when you renounce your citizenship if you meet certain criteria.

In order to calculate the amount of exit tax that you owe you need to file the form 8854 which is an expatriation statement that is attached to your final dual status return and. When a person expatriates or gives up their US. The HEART Act also added the inheritance tax a 40 flat tax on.

In the context of US personal tax law expatriation tax also known as exit tax is a tax filing procedure that needs to be completed by some individuals who give up their US citizenship or. Currently net capital gains can be taxed as high as. Note that you are required to pay the Exit Tax without having.

The Exit Tax is computed as if you sold all your assets on the day before you expatriated and had to report the gain. Generally if you have a net worth in excess of 2 million the exit tax will apply to you. The exclusion amount is indexed annually for.

Citizenship they may owe Expatriation Tax The Expatriation Tax is a capital gains. Exit tax is calculated using the form 8854. We offer tax planning strategies to reduce or eliminate your tax liability.

A covered expatriate is permitted to exclude from tax a certain amount of gain that is deemed earned under the mark-to-market rule. Your average annual net income tax for the 5 years ending before the date of expatriation or termination of residency is more than a specified amount that is adjusted for inflation 162000. The IRS considers the present net.

The Exit Tax calculates the tax the and makes you pay that tax as the price of relinquishing US. The Exit Tax Planning rules in the United States are complex. Citizens Green Card Holders may become subject to Exit tax when relinquishing their US.

Your average annual net income tax liability for the 5 tax years ending before the date of expatriation is more than the amount listed next.

Tax Resident Status And 3 Things To Know Before Moving To Us

California Taxpayers Can Check Out Any Time They Like But Lawmakers Still Want To Tax Those Who Leave

Us Exit Tax Giving Up Us Citizenship Or Green Card The Wolf Group

Us Exit Taxes The Price Of Renouncing Your Citizenship

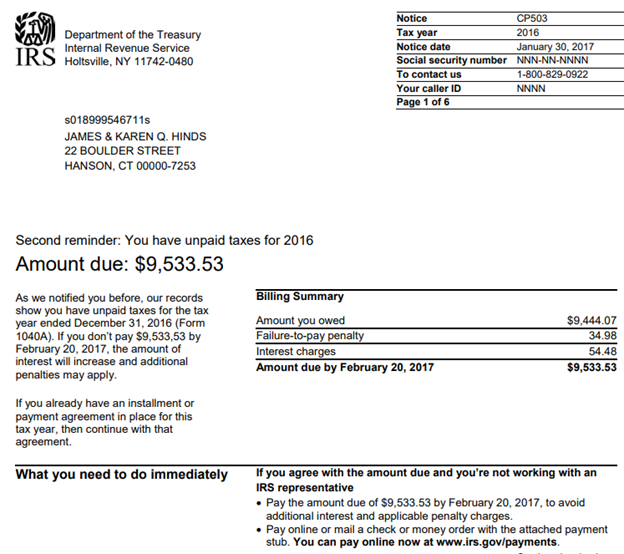

Solved Program Specifications Write A Program To Calculate Chegg Com

.png)

How The Us Exit Tax Is Calculated For Covered Expatriates

Ultra Millionaire Tax Elizabeth Warren

Renouncing U S Citizenship What Is The Process 1040 Abroad

How To Escape The Exit Tax Escape Artist

Exit Tax In The Us Everything You Need To Know If You Re Moving

Will We Owe The Exit Tax When We Sell Our Home Nj Com

Tax Calculator Vanguard Charitable

Robotic Process Automation Rpa For Tax Deloitte Us

U S Exit Tax And Fatca 30 Withholding

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

Capital Gains Tax Calculator Capital Gains Tax Calculator Exchangeright

Us Exit Tax Calculations At Expatriation Important Tips Youtube

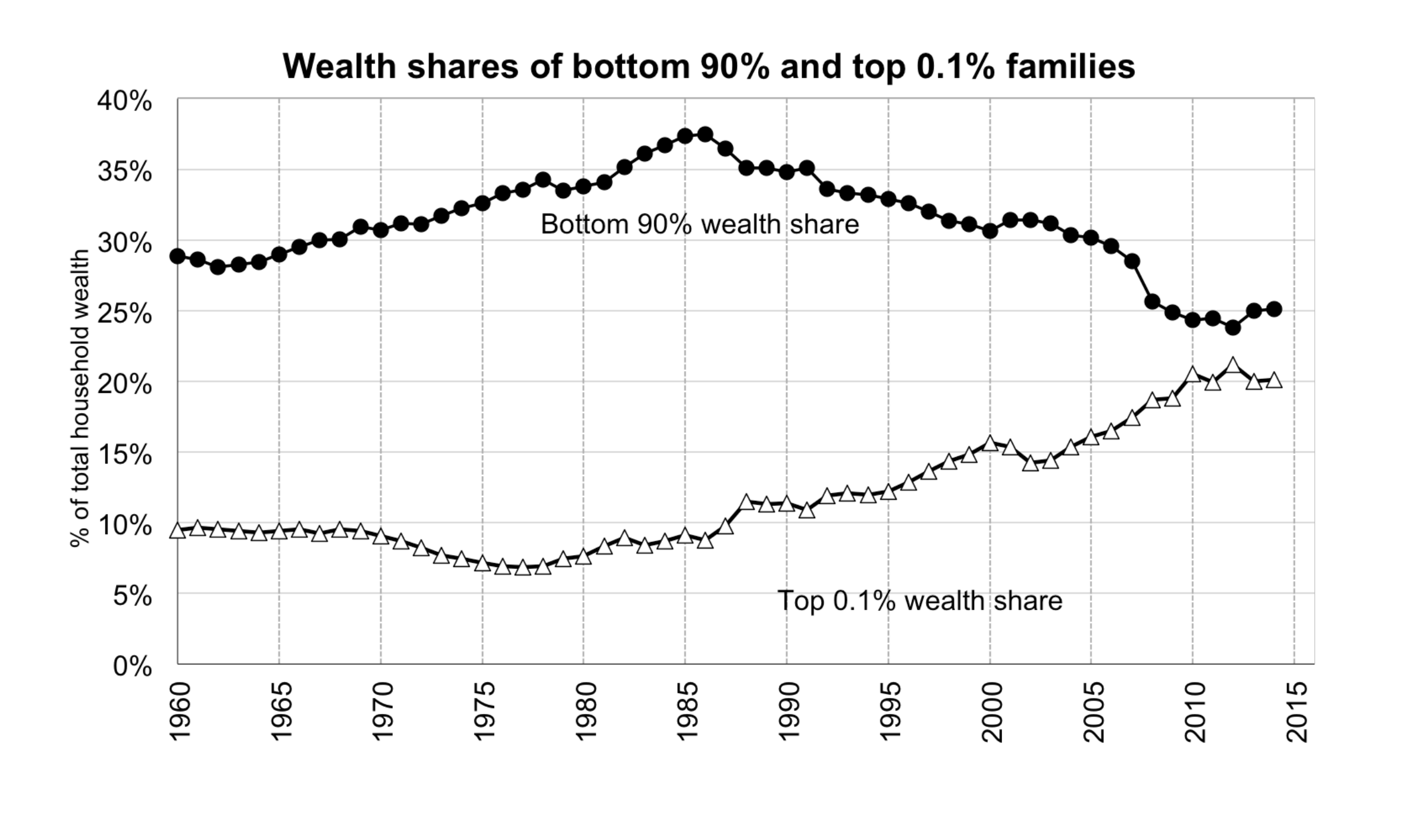

How Long Do You Really Have To Respond To An Irs Tax Due Notice The Wolf Group